Photography Sales Tax & South Dakota v. Wayfair

If you haven't already started reviewing the South Dakota v. Wayfair case, you may now have some tax liability on the books. Before the case, you were only subject to sales tax if you had nexus in a state. You could easily sell digital photos, and have your business somewhere else, allowing you to grow quickly and pick up as many gigs as possible. Not anymore. With South Dakota vs. Wayfair, this business has become a lot more complicated overnight, and could potentially ruin small businesses and overcomplicate digital photography, sinking companies with sales tax liability and accounting fees.

So what happened? Well, it's all about South Dakota v. Wayfair; the Supreme Court ruled in favor of South Dakota on June 21st, 2018. Prior to this ruling, an online seller only had to collect sales tax from buyers in states where the online seller had a physical presence. This physical presence requirement was known as "sales tax nexus." By ruling in favor of South Dakota, The Supreme Court has decided physical presence is not required. Therefore, states are no longer bound by the concept of sales tax nexus. Instead, any state is allowed to require that an online seller who makes a sale into their state collect sales tax. This adds a significant sales tax compliance burden for online businesses.

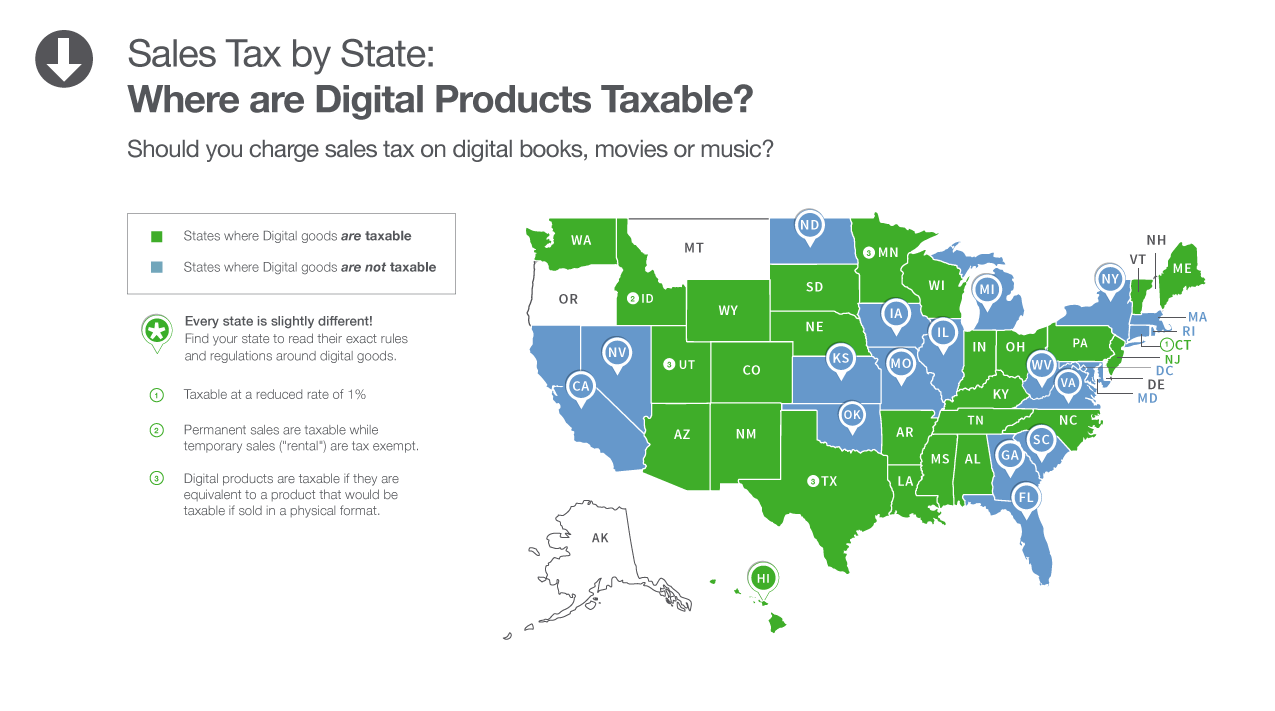

Additionally, how are digital goods taxed? Well, digital photography is a unique case and handled differently by each state and can even change county by county, or city to city within states. This can become pretty complicated if you were photographing an on a state border; do you have to file with both states now? Because this is now a liability, every company is now responsible for figuring this information out, figuring out if they owe, how much, and filing with every one of these entities. If you don't, there are stiff penalties, which also run state to state. Possible penalties run from an audit all the way to criminal implications such as fines and jail time. Florida runs a misdemeanor criminal charge for business owners who 'knowingly' fail to file sales tax returns.

Therefore, if you plan to sell to users in different states--and these people may live in different states than where you were photographing, you'll need to remit sales tax in each of those states. At Flashframe, our goal is to make the lives of our users easier, therefore we have made the executive decision to incorporate the sales tax filings as apart of our processes. Therefore, if you sell a product in a state through Flashframe, we will not charge you anything additional outside of our regular pricing to remit sales tax. If you're outside of the US, you will be the merchant of record and responsible for your own country's sales tax. However, if you're in the United States, when we direct deposit your bank account for photography sales, you have no sales tax issues to worry about as we will file with every entity on your behalf (we won't do your income tax filings, that's on you). We feel like this will be a major benefit to our platform, and give our users the peace of mind that their businesses are squared away and compliant.

Please note: This blog is for informational purposes only. Be advised that sales tax rules and laws are subject to change at any time. For specific sales tax advice regarding your business, contact a sales tax expert.